Does your employer’s 401(k) plan allow Roth deferrals? If so, you may be wondering if that’s a good choice for you. In fact, you may have been wondering about this for a few years now! Even though the Roth 401(k) option has been around more than a decade, and even though many 401(k) plans now allow it, the fact is that relatively few participants take advantage of it. Let’s bridge this education gap!

How Roth deferrals differ from traditional pre-tax deferrals

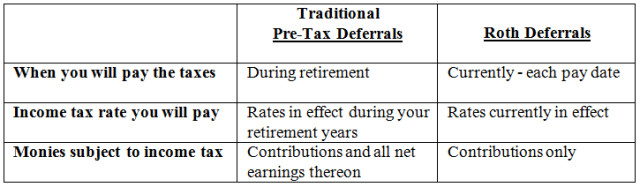

With pre-tax elective deferrals, you make tax-free contributions to your 401(k) plan, but then you pay income taxes on distributions out of your plan in retirement.

With Roth elective deferrals, you pay income taxes up front on the contributions to your 401(k) plan, but then you receive tax-free distributions out of your plan in retirement.1

Because of this basic difference, note the following facts:

You may feel the first point in the table above makes you to lean toward wanting to contribute pre-tax elective deferrals – because you like the idea of paying less income taxes currently and therefore having more take-home pay right now. How will you feel in retirement, though, when you may be living on a fixed income, and income taxes significantly reduce distributions you receive? You really just don’t know. Unless you somehow know you will be well-off during retirement, it could be very difficult to see those tax dollars go out the window.

You may also feel the second point in the table above makes you to lean toward wanting to contribute pre-tax elective deferrals – because you feel you will have less taxable income during your retirement years, and therefore you will be in a lower tax bracket and paying a lower income tax rate than you do today. The fact is, however, that most people really don’t know if their income tax rate will be lower during retirement. After all, the current maximum individual income tax rate is actually relatively low right now. Income tax rates, tax brackets, the standard deduction, taxable income thresholds for deductions, etc. are all determined by Congress – they can and do change relatively often. The entire income tax structure could even change before you retire.

The big deal about Roth deferrals

Never pay taxes on the earnings

The third point in the table above is actually the game changer here – the real advantage of Roth 401(k) contributions is tax-free net gains. If you pay taxes on only your contributions, which is the case with Roth elective deferrals, then you will be paying taxes on less money. Many experts feel this trumps everything else. You will never pay income taxes on the interest and dividend income or the net increase in market value in a Roth 401(k) account. Your contributions will grow tax-free for decades. With a traditional pre-tax 401(k), however, you pay tax on the principal (your contributions) AND the net gains when you take the money out.

More bang for your buck

Whatever your savings goal for retirement, you always have to consider that a large chunk of any traditional pre-tax balance in your 401(k) account will eventually be used to pay income taxes, whereas your entire Roth balance will be available to you. Therefore, Roth contribution dollars are worth more to you in your account than traditional pre-tax contribution dollars. In 2017, the 401(k) elective deferral limit is $18,000. If you are age 50 or older, you can contribute an additional $6,000. This annual limit is the same regardless of what type of deferrals you make – Roth, pre-tax, or both. If you can afford to contribute the maximum, you are really able to save much more by contributing Roth deferral dollars.

Opportunity to invest your retirement money longer

Regardless of whether your 401(k) account includes a Roth balance, a traditional pre-tax balance, or both, you must begin taking required minimum distributions (RMDs) from your account once you reach age 70½ if you are no longer working (or if you own at least 5% of the plan sponsor), or pay a penalty. However, you can avoid this requirement on the Roth portion of your account when you retire if you roll it over tax-free into a Roth IRA. This is because, unlike a traditional IRA, a Roth IRA has no RMD requirement, so your retirement money can continue to grow tax-free and compound and, if not withdrawn by you during your lifetime, pass on to your heirs tax-free.

Who benefits the most from making Roth deferrals instead of traditional pre-tax deferrals

Investment time horizon considerations

A Roth 401(k) is particularly suitable if you won’t be retiring for a long time. This is because your contributions will grow tax-free and compound over many, many years. A Roth 401k is almost always better than a traditional 401(k) if you are in your 20’s or 30’s.

Tax considerations

Currently, a retiree’s taxable income affects the amount they pay in Medicare premiums, the tax rate they pay on their Social Security benefits, and the availability and limits of certain income tax deductions. If these are concerns to you and you are nearing retirement, then reducing your taxable income in retirement would be beneficial. In this case, it makes sense to favor Roth elective deferrals over pre-tax elective deferrals – because Roth distributions are not taxable income.

Other considerations

Paying taxes years earlier than necessary

It’s tempting to think that when you make Roth 401(k) contributions, you are volunteering to pay taxes many years earlier than you need to, and that with a traditional pre-tax 401(k), you would have extra take-home pay to set aside as savings. There are three flaws to this thinking, though. For one, most people are not disciplined enough to save additional money out of their paychecks once it is available, so it’s likely you would not save it. Another flaw is that even if you are able to pull this off, you are saving money upon which you have already paid income taxes, so it is already somewhat depleted to begin with. Finally, the earnings on a savings account or certificate of deposit pale in comparison to the net gains possible from investing in the market through a 401(k) plan over the long-term.

Concerns about having a diversification between pre-tax and after-tax retirement money

If you’re still not sure whether a Roth 401(k) makes sense for you, one strategy is to contribute to both a Roth 401(k) and a traditional 401(k). The combination will provide you with both taxable and tax-free withdrawal options in your retirement.

If you like this idea of having both withdrawal options, and your plan sponsor contributes either a company match, a safe-harbor contribution, or a profit sharing contribution to your 401(k) plan though, you can still contribute only Roth elective deferrals and achieve the same result. This is because such plan sponsor contributions are all pre-tax investments. Those contributions and the net earnings on them are always taxed as ordinary income when you take distributions of them in retirement.

Conclusion

Hopefully you are now armed with all the facts you need to make an intelligent decision on whether or not the Roth 401(k) option is right for you. As you can see, you need to consider several issues. If you feel you need additional guidance, your plan administrator can have you speak with someone who provides investment education to participants in your plan. Another great resource is a certified public accountant. Good luck!

1For Roth distributions to be completely tax-free, you must be at least 59½ years old and have held the account for at least five years prior to your first withdrawal. If you do not meet these conditions, distributions of your Roth contributions are still tax-free, but distributions of your net earnings are taxable, and you may incur a 10% penalty tax.

Written by: Debi Ondrik, CPA